Considering the

current competitive market conditions, the maximum use of organizational

resources in line with goals is important to the extent that it can be noted

that all organizational improvement models have been developed and focused on

this issue. In this regard, one of the proposed strategies and methodologies is

risk management, the main focus of which is the uncertain conditions and

management.

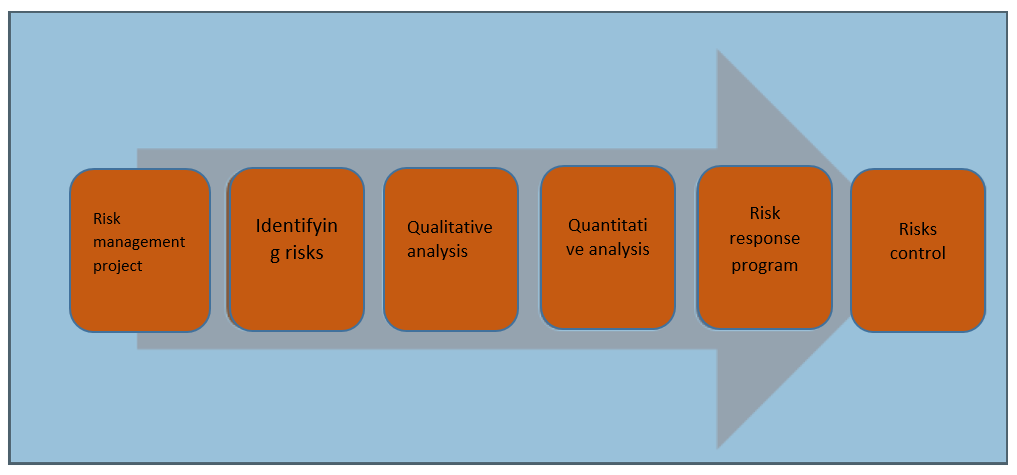

Risk management involves planning, identifying, analyzing, designing, reacting

and controlling the risk of a project/organization.

Risk management objectives include increasing the likelihood and impact of

desirable events and reducing the likelihood and impact of adverse events of project/organization.

Risk management planning: The process of defining how to manage a project /

organization's risk management activities

Risk identification: The process of identifying risks that may affect the

project / organization and documenting their features.

Implementing a qualitative risk analysis: The process of prioritizing risks for

more analysis or action by measuring and integrating their likelihood and

impacts.

Implementation

of quantitative risk analysis: Numerical analysis process of the effect of

identified risks on the overall objectives of the project/organization.

Risk response planning: the process of adopting options and measures to

increase opportunities and reduce threats to goals of project / organization.

Risk monitoring and control: The process of implementing programs of risk

response, tracking identified risks, monitoring the remaining risks, identifying

new risks, and evaluating the effectiveness of the risk process throughout the

life cycle of the project/organization.

In this regard,

AKPC acted according to ISO 31000 model to implement risk management and, using

the consulting company, took the following steps:

Organizing ISO 31000 training courses

Understanding concepts, model and process of risk management

Holding workshops for implementation of risk management process with presence

of different organizational units

Organizing internal meetings for finalizing internal risk management procedures

Holding meetings of risk management committee with the participation of senior

executives of the organization

It should be noted that all actions were carried out according to three main

parts of the model:

The principles of the ISO 31000 model

The framework ISO 31000 model

The process of ISO 31000 model

Regarding clause 1, all cases emphasized by the model were addressed in the

policy and regulations and were explained in the training sessions.

In the framework of ISO 31000 model, using the procedures and guidelines

presented, a mechanism was developed for risk management adapted to the terms

and conditions of the organization, including 3 internal instructions.

Risk Identification Instructions

Risk Analysis Instructions

Risk Response and Control Instructions

And all inter-organizational requirements and practices were considered in the

risk management mechanisms by receiving views of senior executives of the

organization. It should be noted that the documentation prepared on the basis

of comparative studies is a unique model in the petrochemical industry of the

country. This issue can be verified on the basis of information from companies

active in the field of petrochemicals (for example, a risk analysis table).

Eventually, the implementation of risk management was performed based on the

proposed model, which was executed by organizational units and according to the

instructions provided by this section of the model while considering the

executive workshops and training sessions and completing the step-by-step risk

register. The steps are indicated in the attachments.

To accomplish all of the above steps, the following actions are briefly done:

1. Designing the risk management deployment committee

2. Introducing the executive representatives of the project

3. Holding several workshop-training sessions

4. Definition and identification of organizational risks in the form of RISK

REGISTER

5. Holding training sessions on risk management including risk identification,

qualitative and quantitative risk analysis, how to respond and controlling the

risks of the organization.

6. Completing the RISK REGISTER form

Finally it should be noted that what successful organizations benefit from is

undoubtedly a planned development based on the organization's lifespan and

maturity. Therefore, the risk management plan should be designed according to

existing conditions of the organization and infrastructure so that it can be

considered as a competitive advantage by institutionalizing the system. Then, risk

management is essential in order to observe maximum achievement of goals,

survive in the competitive world, create competitive advantage for sustainable

development, raise the margin of profit and take the advantage of short and

long term material benefits. It is hoped that we can take advantage of its

sustainable results by the continuous implementation of risk management in the

coming years.